As we hit the midway point for June 2023, here’s where we stand:

- Number of sales is down 39.89% from this time last year.

- Homes are selling 1.27% below original list price.

- Homes under contract went UC at 2.5% below their original list price (this is not a measure of what they will close at, necessarily, but hints at a 1% price drop in the next couple of weeks).

- Inventory is at 1.64 months.

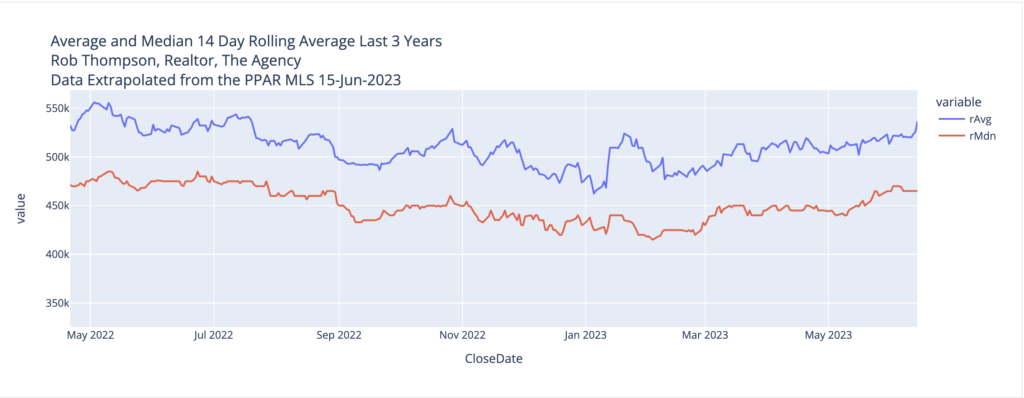

- Interestingly, the 14 day rolling average on pricing indicates we are within 3.58% of peak pricing (last May).

What does all of this mean for the market? Inventory is keeping prices from falling. This is likely to remain the case so long as the Fed continues backstopping the market and the demand there is out there doesn’t fall off.

TLDR; sales numbers way down but pricing has climbed back up, too few homes for sale.

Here is the 14 day rolling average and median pricing since May 2022.

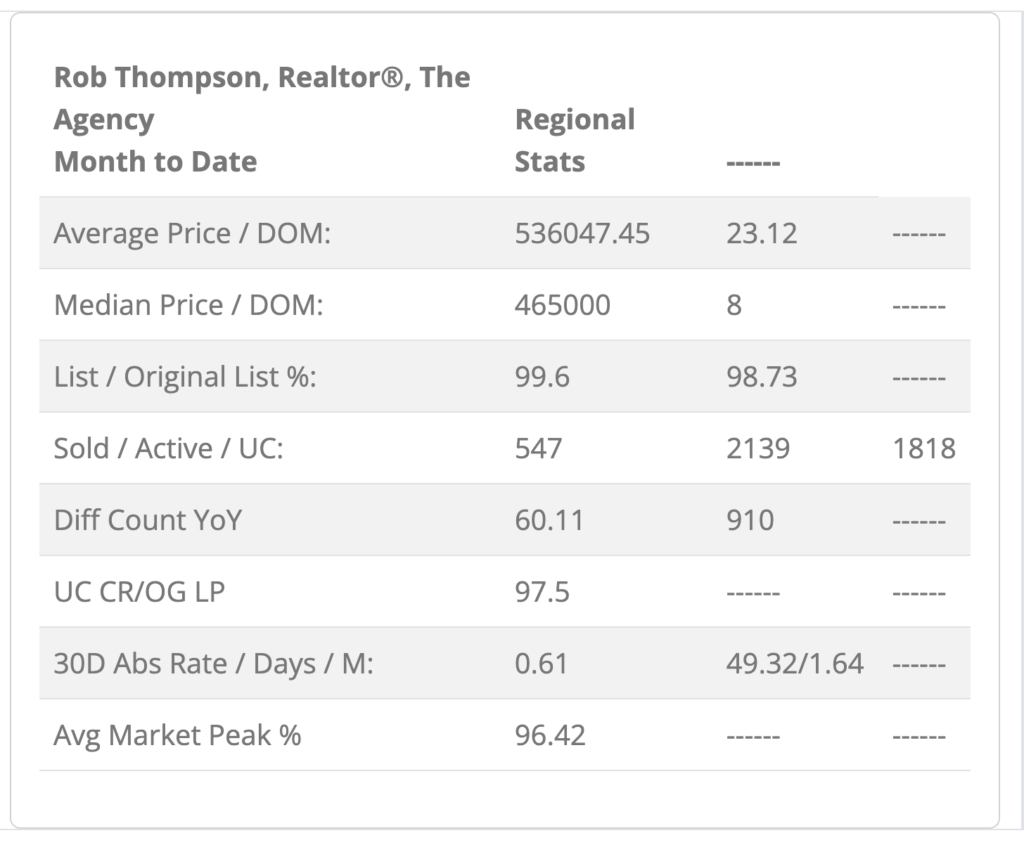

Here is the month to date snapshot.