Cash is king, the mantra goes. But is it true?

Let’s take a look at Colorado Springs year to date.

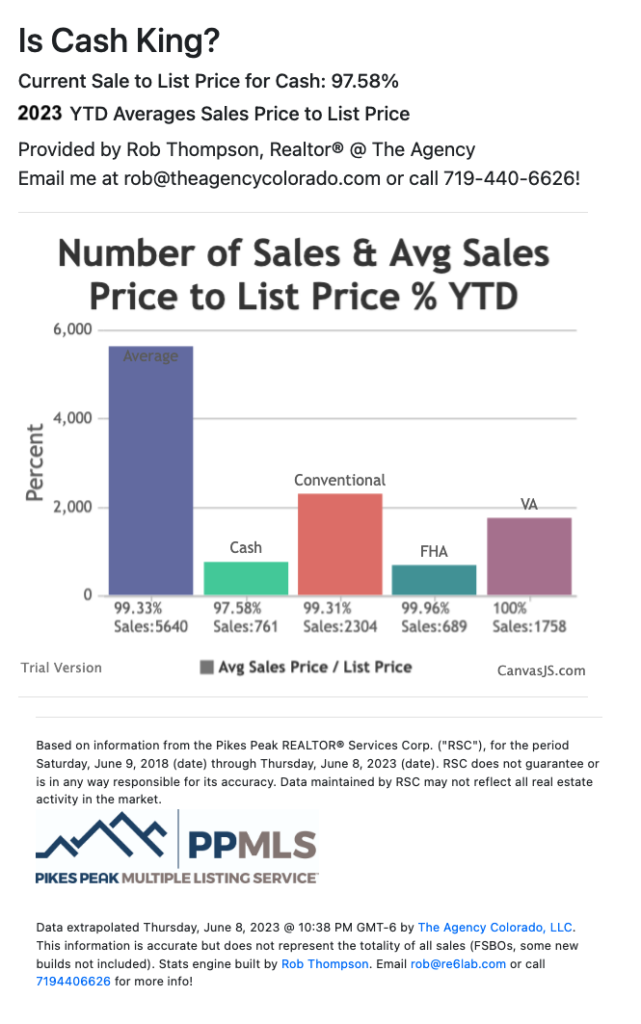

What you see below is the breakout of purchase types by number of sales and their closed to list price ratios. The way to read this is as follows:

- There have been app 5,640 sales year to date, selling at 99.33% of their list price.

- There have been 761 cash sales, selling at 97.58% of their list price (or a discount of 2.42% off of list).

- There’ve been 2,304 conventional sales, selling at a discount of .69%.

- There’ve been 689 FHA sales, selling at a discount of .04%.

- There’ve been 1758 VA sales, selling at a 100% of list price on the average.

Cash is commanding a 1.75% discount over the average sale price, a 1.73% discount over conventional, a 2.38% discount over FHA and a 2.42% discount over VA. With an average year to date close price of $506K, that equals an app discount of $8,855, $8,754, $12,043 and $12,245.

Is that a kingly discount? It’s not as much as one might think it should command but it’s nothing to ignore, either.

Thank you so much!!! This is very interesting information. I wonder if “cash is King” as long as it’s liquid, in this economy. I think so, in a recession. Once you buy a home, it is not liquid. I wonder if the sale of Muni bonds and other “liquid” forms of investment money are increasing. Of course, housing provides a need and other benefits in the long run and not necessarily a return on your investment. There may be a time in the near future where CASH will be king again but not now.