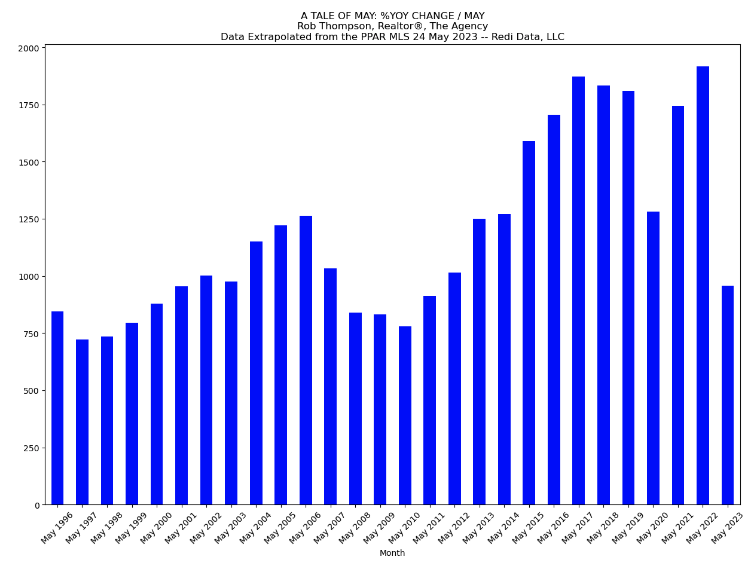

As we enter into the last week of May 2023, we are tracking at 67.9% of last year’s sales numbers for the same period of time (May 1st through 24th). It’s likely we will close at 2013 – 2014 levels.

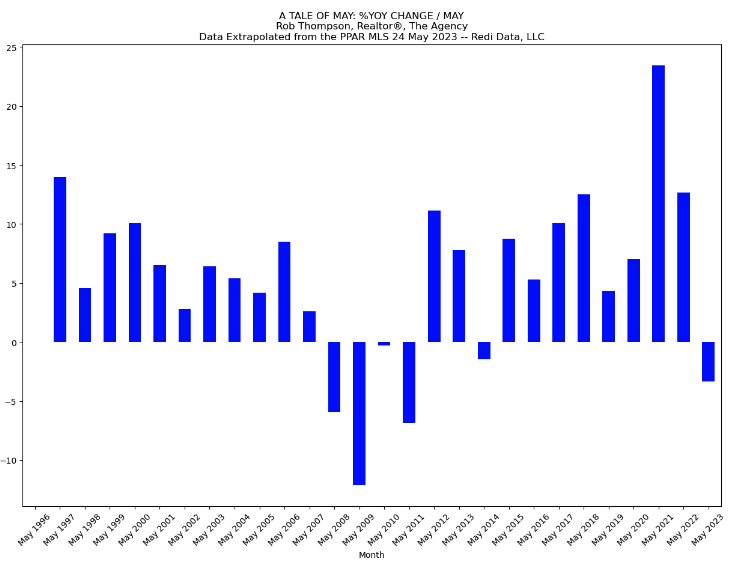

We are also selling about -3.35% for average home prices. I honestly expected a bigger year over year lost given interest rates.

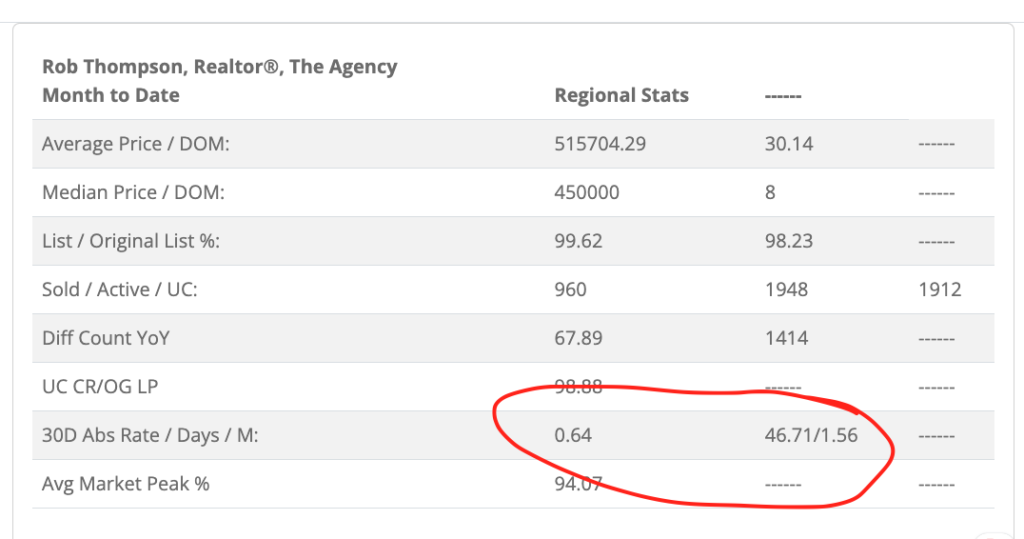

What’s keeping prices up? Inventory. At this time, we have 1.56 months worth of homes on the market.

Where is this headed? I suspect we are in for a slow burn. The Fed has shown their willingness to do whatever they can to keep the market slowly burning. This does assume everything remains equal.

Will there be a crash? Only if there is a Black Swan event (re Nassim Taleb).

What is a Black Swan? It’s an unpredictable event that causes an outsize impact. However, even then if the Fed will just backstop these events, will that impact register?

If this article resonates with you, please consider following me and connecting via The 411 for the 719 by clicking the badge below.