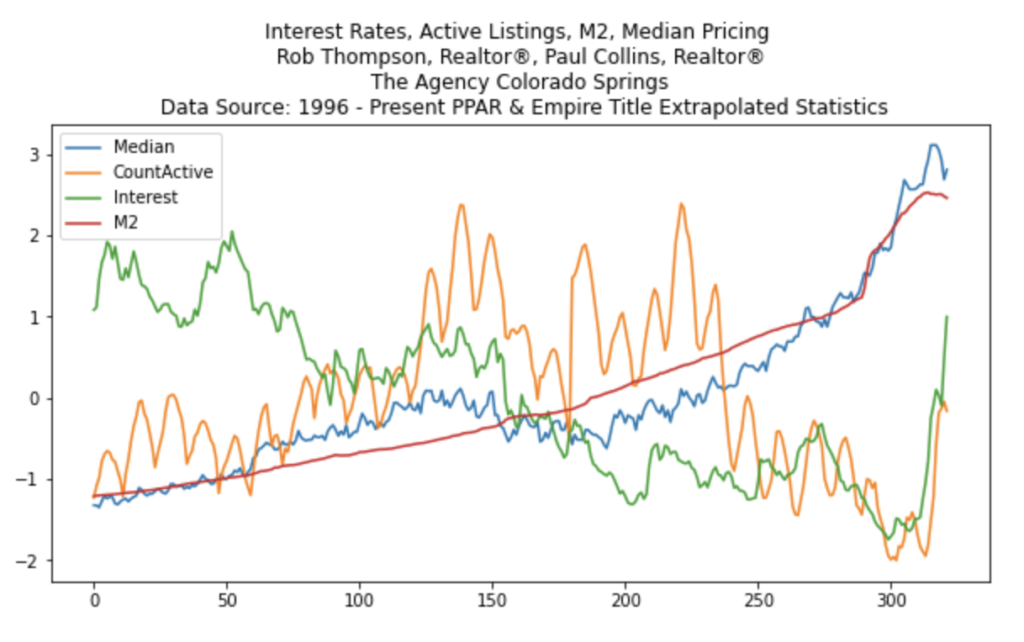

There is a .9 correlation between the M2 money supply and median pricing in the PPAR region over the last 26 years through October of this year. That is a high level of correlation, indicating a strong relationship between the two. By contrast, the R2 for interest rates to median pricing is .43. The R2 for count of active homes for sale to median pricing is .11.

What does that mean for us? Watch the M2 to see where housing goes.