There are a lot of statistics out there! What are the core stats you should know when looking at a market?

- Average and Median Price: the average is the sum of sold prices divided by the number of sold homes. E.g., as of 13 February 2022, there have been app 1803 homes sold for a total sum of $876,116,305. Dividing the sum by the number sold returns an average home price of $485,921.41. This is important because it is a market barometer. It gives a good general indicator of a market.

But there is a flaw with this measure in that it is by definition a market average, including the high and low in a market. Another, sometime better indicator is the median price. This is the literal halfway point in a range. E.g., if we take the hypothetical sales prices of $300,000, $300,000, $325,000, $425,000, $435,000, $475,000 and $800,000 the average is $437,143. However, the median $425,000. The median is the literal middle of the numbers and can be a more accurate specific measure of a market. Here in Colorado Springs, the median sale price YTD is $439,900. - Average and Median Days on Market: the average days on market for the last 30 days in Colorado Springs is 15.28. The median is 4. Days on market is a barometer – an indicator – as well. The longer a home is on the market, the more likely a seller will be willing to take a lower price for it. This isn’t always the case but it does have a higher probability. The difference between average and median is important; if one looked at the average for a market it may appear a given home will be on the market longer than it will. Here 50% of the homes are on the market for four days or less, not the two weeks the average makes it appear.

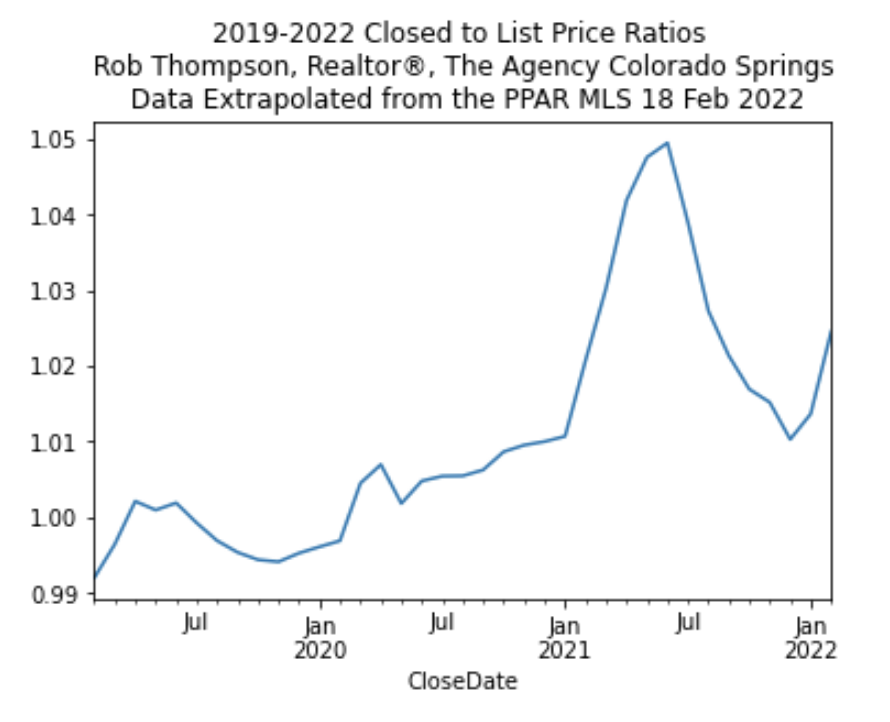

- Average Close to List Price Ratio: this is one my favorite measures. This is the percentage above or below the asking price a home sellers for. The average is a good market indicator. Here in the Springs, homes year to date are selling for 1.64% more than asking price, on average. But even, this statistic can be drilled down into by types of purchase. E.g., cash is 1.05%, conventional is 1.81%, FHA is 1.5% and VA is 1.97%.

- Average and Median Seller’s Concessions: seller’s concessions are often referred to as “closing costs”. However, I think it’s important to split this hair. Sometimes, I hear people say “the seller covered my closing costs” but this is often an inaccurate statement. Sellers can contribute toward a buyer’s closing costs and do so through seller’s concessions toward the same. Here the average month to date is $1,366. But the median is zero. Fifty percent of buyers receive no concessions toward closing costs.

- Absorption Rate: the absorption rate is the amount of inventory a market has on hand. A balanced market is said to have 5 to 6 months of inventory. Colorado Springs has 691 homes for sale right now. We have sold 1098 homes in the last 30 days. Or absorption rate is 1.59%, which means we would sell the existing inventory in around 6 weeks if no more homes came on the market.

Be REALLY cautious with this statistic and critically examine any claim you see as this statistic can be manipulated to cause fear. While 6 weeks is CLEARLY in the “seller’s market” territory, I have seen claims of two weeks in our market. Depending on how and what is being measured, this stat is a powerful one. For example, the 1.59% is the market absorption rate for 30 days. But it’s for all structures and doesn’t include homes under contract, just actively listed and sold. We could look at Single Family Homes (SFH) alone. The absorption rate for SFHs is currently 1.55%. But if we include homes under contract and pending, the rate is 2.38%, or 9-10 weeks of inventory. This is an example of how the statistic can be misinterpreted, intentionally or not. Ask, “What is being measured? What is being excluded?” before citing this measure.

These are some of my “go to” measures for a market. The more you know, the better decisions you can make when buying or selling a home.

If I can help, please give me a call, text or email at 719-440-6626 or robthompsonrealtor@gmail.com!

Rob Thompson, Realtor®, MBA