Yes, yes it is. In a number of ways.

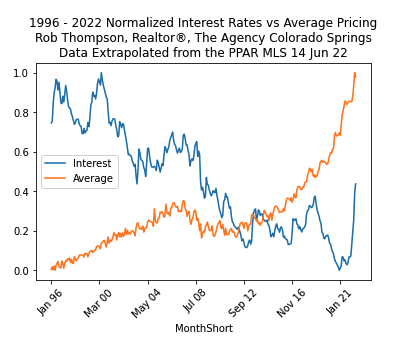

Let’s take a look at interest rates then and now. “Rates are actually on par right now with the 2008 trend,” I see and hear that being said quite a bit. That’s true.

However, that discounts pricing as a factor in the affordability issue we face right now. The chart below maps interest rates against average pricing over the last ~26 years in the Colorado Springs area. As you can see, average pricing in mid 2008 was quite lower than it is in 2022. Specifically, the average price of a home in June 2008 was $256,829. It is currently – June 2022 – sitting at $522,701, or over 2x the previous value. All things remaining equal, this nearly doubles the payment. If we factor in the cost of insurance and taxes, it more than doubles the payment.

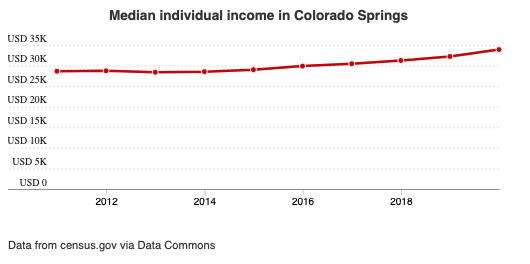

Well that might not be such a big deal because wages have increased, right?

Not so much.

The short of it is: a return to 2008 interest rates at these average prices is a very big problem. The median income homeowner and would be homeowner cannot afford these payments. The logical outcome here is prices must and will come down.