The real estate market in Colorado Springs has been a subject of interest for both investors and homebuyers. While many factors influence home prices, one less-discussed variable is the M2 money supply. M2 includes a broad spectrum of financial assets, such as cash, checking deposits, and easily convertible near money. Understanding the correlation between M2 and home prices can offer valuable insights into market trends and investment strategies.

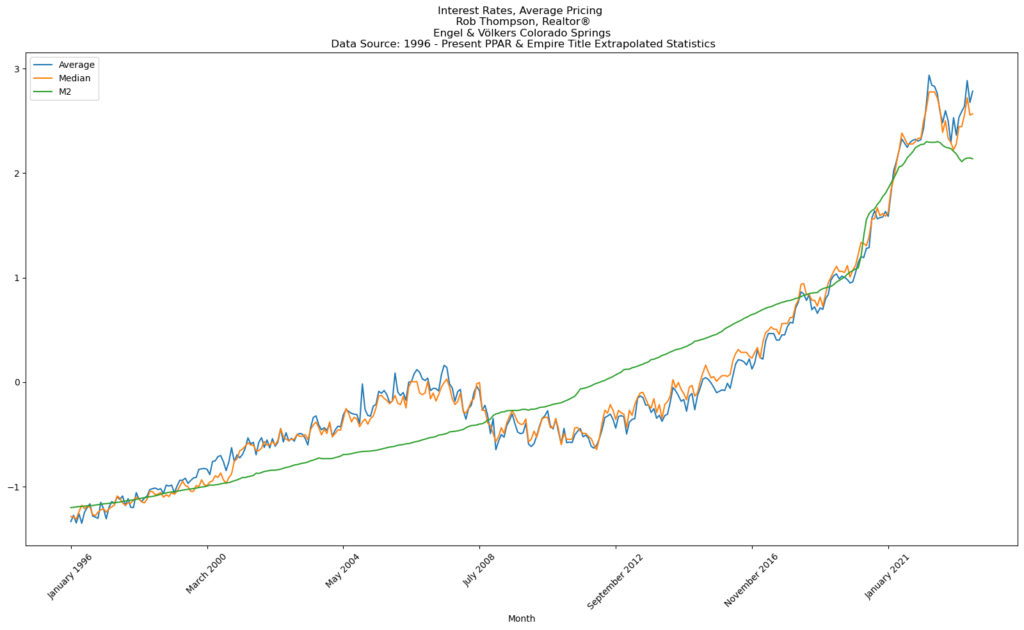

In this article, we will explore the statistical relationship between the M2 money supply and the average and median price of homes in Colorado Springs. With an R-squared (R2) value of 0.886 for the average home price and 0.916 for the median, the correlation is strong, suggesting that changes in M2 can be a significant predictor of home prices in the region.

What is M2 Money Supply?

M2 money supply is a measure of the money supply that includes more than just physical money such as coins and currency. It also includes demand deposits, savings deposits, and other near-money assets. Economists and policymakers often monitor changes in M2 as it can be an indicator of economic stability and future monetary policy actions.

In the context of real estate, the M2 money supply can influence mortgage rates, lending practices, and ultimately, home prices. For example, an increase in M2 could lead to lower interest rates, making it easier for people to borrow money for home purchases. This, in turn, can drive up demand and home prices.

The Statistical Correlation

The R2 value is a statistical measure that represents the proportion of the variance for a dependent variable that’s explained by an independent variable. In our case, the R2 value of 0.886 for the average home price and M2 indicates a very strong positive correlation. This means that as M2 increases, the average home price in Colorado Springs is likely to increase as well.

Similarly, the R2 value of 0.916 for the median home price and M2 is even stronger, suggesting that nearly 92% of the changes in the median home price can be explained by changes in M2. For investors and homebuyers, these high R2 values serve as a compelling reason to monitor M2 trends when assessing the Colorado Springs real estate market.

Real-World Implications

Understanding the correlation between M2 and home prices can have real-world implications for both investors and potential homebuyers. For investors, a rising M2 could signal a good time to invest in real estate, anticipating that home prices will likely follow suit. For example, if the Federal Reserve announces an increase in M2, investors might consider it a favorable time to buy properties in Colorado Springs.

For potential homebuyers, understanding this correlation can help in making informed decisions. If M2 is on the rise, it might be wise to expedite the homebuying process to lock in current prices before they increase. Conversely, a decrease in M2 could signal that waiting a bit longer might result in more favorable home prices.

The strong correlation between M2 money supply and the average and median home prices in Colorado Springs offers a unique lens through which to view the real estate market. With R2 values of 0.886 and 0.916, respectively, M2 serves as a significant predictor of home prices in the region. Whether you’re an investor looking for the right time to enter the market or a potential homebuyer trying to get the most bang for your buck, understanding this correlation can be a valuable tool in your decision-making process.

By keeping an eye on M2 trends and understanding their impact on the real estate market, you can make more informed decisions, whether you’re looking to buy, sell, or invest in Colorado Springs real estate.

Are you looking to buy or sell a home in the region? Please consider giving me a call.

Rob Thompson, Realtor®, MBA, MSgt (Retired), USAF

Engel & Völkers Colorado Springs

719.440.6626

www.shouldIbuyahousetoday.com

robthompsonrealtor.com