There are a LOT of what if’s in this question. There is no one size fits all answer here. Instead, let’s look at it from a top down perspective.

First, you cannot time the market. There are simply too many variables (I say this, too, as a programmer with some working knowledge in statistics, markets and machine learning). We can get to a sense of ‘I think the market is going in this direction but…’

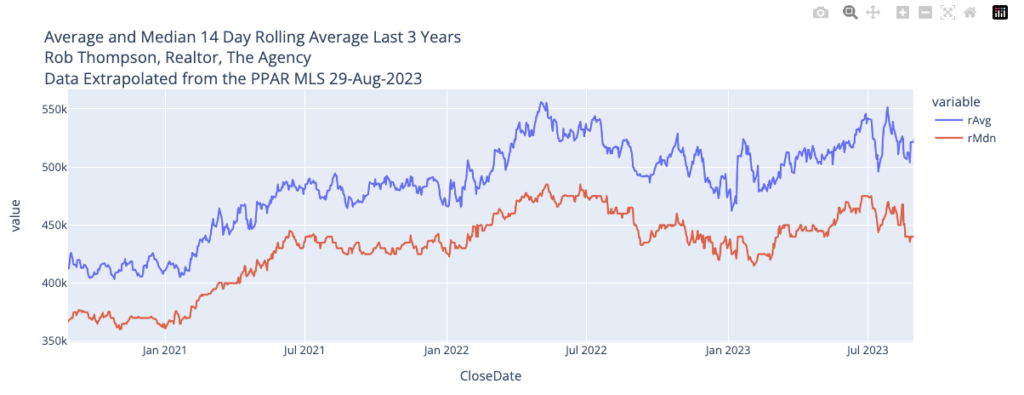

Let’s look at the last three years in Colorado Springs. What you see here is average and median prices over this time, measured in 14 day rolling averages. As of right now, we are 6% down from the peak of the market in May 2022. We were within 1% of the May 2022 pricing in the last week of July 2023. A month later, we’ve come down 5%. I share this as an example of the principle that you can’t time the market. This four week shift is literally unpredictable, being the function of so many various factors.

Ok, great, you’re probably thinking…if we can’t predict the market, what can we do? Let me show you one more graph before I answer that question.

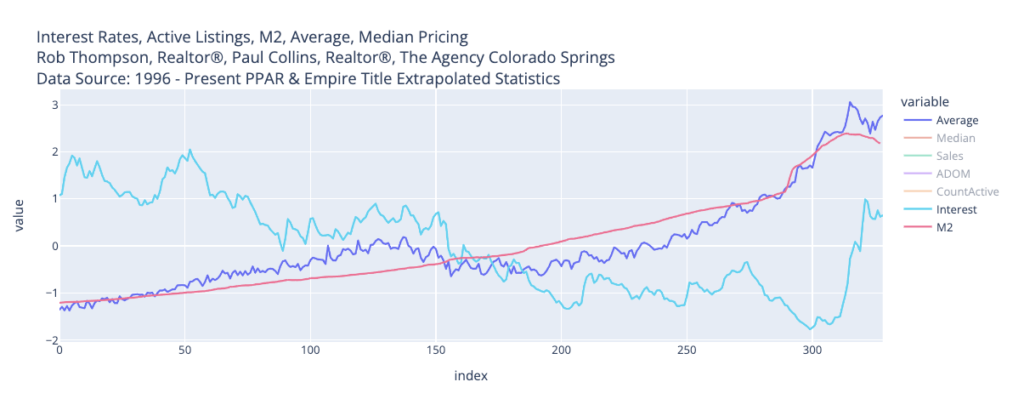

What you see here is 27 years of average prices, interest rates and the supply of short term money in the United States. Interest rates do not impact the market like most folks think they do. The supply of money has a far greater impact. The red line is kind of deceptive in it’s curve…the rapid uptick around the 280th data point? That’s trillions of dollars since 2020 injected into the economy. I show this to say this: we don’t know how this plays out. If you could call the housing market an equation, say “x + 5 = 6”, before 2008, we could say with some certainty that the market would react in a logical fashion. But that equation is more like this now: x + y + z = 5 or 6 or 7 if a is > 72 and z < 2.

We simply don’t have a mathematical model for the circumstances right now.

All that said, what do we do?

We can make the best decision we can, given the information we have at the time.

Real estate is a long term wealth builder, the key being long term. Anything you do, particularly right now, I believe the core, key question is this: is this a long term sustainable decision for me?

Ask: can I hold this property at these rates and payment, if I can’t refinance later?

There is a mantra being stated across social media right now: date the rate, marry the house.

This is dangerous.

This is dangerous because you may not be able to refinance your house:

What if rates don’t come down significantly?

What if home prices fall? Will you have the equity you need to refi?

You are marrying the house AND the rate.

Maybe you need to sell, though, and it makes sense to buy for the long haul and given the conditions above. What then? What can you do in an uncertain market?

Here are some options:

- You may be able to make an offer contingent on the sale of your existing home. In this scenario, you make an offer to buy property B on the condition that property A sells by a certain date. The risk here is that A doesn’t sell by the deadline, requiring either the termination of B purchase or the forfeit of earnest money.

- You might consider selling property A and finding temporary housing while you purchase property B. The big risk here is that if something happens to the market or your financing or both, you may be unable to purchase B, turning that temporary housing search into a long term rental situation

- Maybe you can pay off A and qualify for B? Here you have to weigh the opportunity cost of the money you would use to pay off A…that is, what is the best use of the funds? With higher interest rates, would it be smarter to use the money as further down payment on B, lowering the overall payment? In a recent sale, I sold property A while occupying B. I then purchased C and moved into it, then rented property B. The proceeds from A I put into a CD, with the intent to use the funds to refinance C when (if) rates drop.

The choice to buy or sale right now…it’s nuanced. This post is meant to provide food for thought as you weigh your options.