It’s often said “Cash is King”. What does this mean?

It usually means two things. One, the belief that cash will usually win the offer. Two, cash tends to win at a discount due to its relative ease.

What ease, you may ask? Cash purchases don’t require appraisals as a condition of financing, which reduces the risk to the transaction. Specifically, that means there isn’t a third party (the lender) involved in the negotiation of pricing. It also means that the third party won’t get involved in any negotiations of repairs (an appraiser can require certain things be repaired). Cash buyers can usually close quicker that financed offers, too.

These benefits of cash often do translate to either an increased acceptance rate (i.e., a seller will often take a cash offer over financing, all else remaining equal). Do these benefits translate to a discount off of list price?

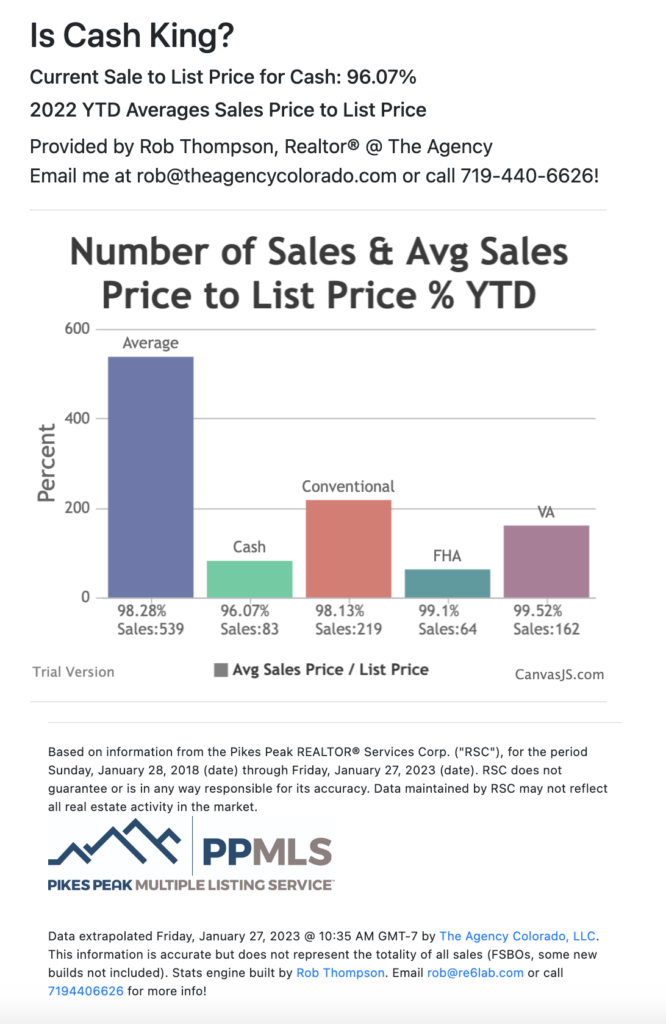

Yes, but not as much as one thinks. Year to date in the region, the average closed to list price percentage is 98.28%. That is, homes are closing at 1.32% below their list price at the time of contract. More on that in a bit. Cash sales year to date are closing at 3.93% below their list price at the time of contract, or 2.61% below the average. So, it’s accurate to say that cash is currently commanding a 2.61% discount off the average closing price in the region right now. As you can see from the chart below, it’s also closing at a discount relative to conventional, FHA and VA loans.

Above, I highlighted at the the time of contract.

Why? Because there is another, more accurate measure we should consider. That is: closed to original list price. Due to way the data is published, this is a little trickier to pull out of the ether. But the closed to original list price ratio year to date for cash is actually 92.4%, meaning cash is commanding a 7.6% discount for 2023 year to date. Also of note is the overall average closed to original list price right now is 94.5%, or a discount of 5.5%.