I’ve been curious for a bit about what pricing might have looked like had the pandemic not hit. As you probably know, the Fed injected trillions of dollars into the economy over the years since Corona. This is in addition to the trillions injected in multiple waves of Quantitative Easing from 2008 through 2014.

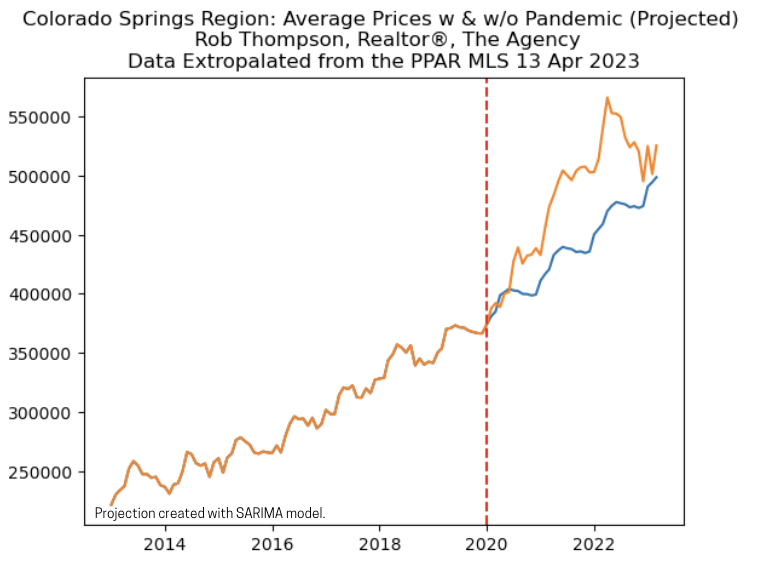

What you see here is a possible answer to that question. The orange line represents actual average month to month pricing. The blue line represents projected pricing using a time series forecasting model called SARIMA. This model is a good one for tracking data that is not as sensitive to movement as stocks (for example) and factors in seasonality. The red line here is the demarcation point: the point the pandemic hit the United States.

We can see according to this model prices would likely have steadily increased to within about $27K of where they currently sit. At the peak of the Colorado Springs market in May of 2022, the spread / projected spread is around $60K. One possible conclusion here is we overshot on pricing due to the money the Fed injected and then have pulled back, reverting to the mean.