Let’s see where we stand for the last 30 days as we close in on the end of the first week of February.

This snapshot of my custom analytics dashboard is PACKED full of information but here are a couple highlights:

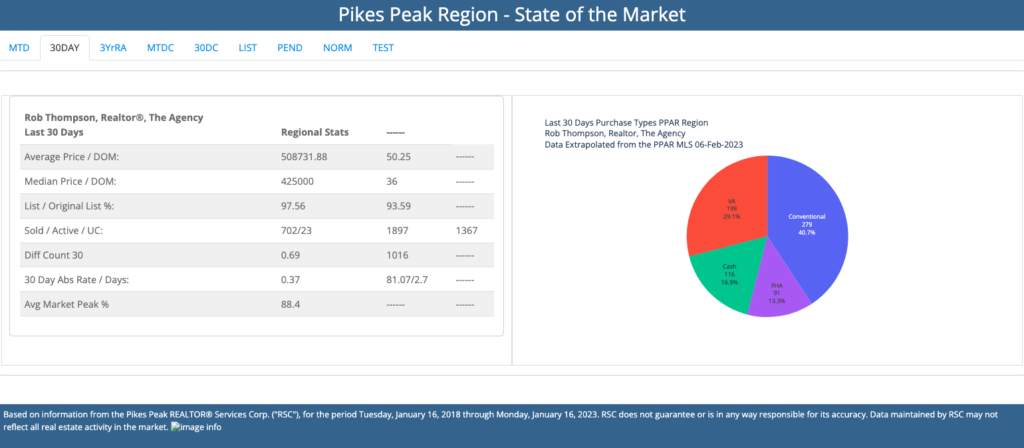

The average closed price is $509K w/50 days on the market. We are closing at 2.44% less than the list price at the time of contract. However, this doesn’t tell the full story. We are actually closing at 6.41% less that the original list price. So homes are having to drop the price around 6.41% to get to closing on the average. One more critical datapoint: the homes under contract for the month of February went under contract at 11.56% below their original list price. Now, we can’t know what those homes are going to close at until they close (i.e., they might close up 5%….or they may close down 2.44% from the 11% figure). But overall, the trajectory still indicates pricing is steadily declining right now.

Will this continue? There are too many variable to accurately predict this but one more measure can give us a sense of the market: the ‘Diff Count 30’ measure here is a measure of the difference between the number of homes sold in the last 30 days vs the same time last year. The .69 indicates we are at 69% of the sales volume of this time last year. This is up from the mid 40s of two months ago. This is a generally positive trend indicating the market is adjusting to these interest rates and pricing. This might be our “new normal”, absent any Black Swan events (I highly recommend Nassim Taleb’s books Antifragile and The Black Swan).

I will close this post out by citing two more measures: we are closing right now an average of 11.6% down from the peak of May 2022 and we have 2.7 months of inventory on hand. The bottom line: the market has slowed significantly but is showing signs of life. Locally, the lack of inventory is keeping the market still fairly active.

If you are looking to buy real estate right now, consider the long haul when making a purchase. We are likely to see little appreciation as the battle between rates, prices and inventory continues. This also assumes all things remain equal. This could also break negative, if one of the countless variables impacting housing or the economy does the same. Ask yourself, “Can I hold this asset for the long term if I can’t sell it?”

If you are looking to sell, I also advise considering the long term. If it’s not a long term hold, I don’t know that the economic outlook favors holding.